Company cashbox

The company cashbox is located in the top right menu. A list of all cash transactions in the company. Most of the table fields correspond to those described in the article Employee cashbox.

However, we recommend checking the cashbox in the context of each employee cashbox. The company cash register can be used if it is necessary to search for a transaction, when it is impossible to determine from the source data that it belongs to a specific employee, or to cancel erroneous transactions.

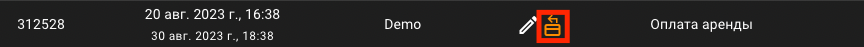

The company cashbox has the option to change the payment date. This can be done by clicking on the Edit icon, then clicking in the creation date field, selecting the desired date and clicking Save.

To cancel a payment, you need to click on the Cancel button in the Editor column and confirm the action. When a payment is cancelled, a corrective payment is created.

Attention!

The payment cancellation operation is irreversible, so use it as a last resort.

After canceling the payment, the administrator must carefully check the employee cashboxes and adjust them if necessary.

At the top of the page the amounts of cash and funds in the company's current account are indicated. Clicking the Cashbox Operations button opens fields for carrying out operations to move funds between the company cashbox and the manager cashbox, as well as withdrawing funds from the company (making a profit).

To move funds through the company cashbox, you must enter the amount in the field Took from the cashbox or Put in the cashbox and select the transaction type Non-cash or Cash . The Internal button transfers the specified amount between the company cashbox and the cashbox of the manager making the transfer. The External button carries out an external withdrawal of funds from the company balance sheet (for example, making a profit by the owner) or receipt of funds on the company balance sheet to finance expenses from external sources (for example, investments). External payments are available only to administrators.

In the input field below you can enter a note about the operation being performed.

Example 1. The manager receives funds from the company current account in the amount of 10,000. To carry out this operation, you must go to the company cashbox, click Cash Transactions, and enter the amount of 10,000 in the Took from the cashbox field , select Non-cash - Domestic, click Save. After the operation, the amount of non-cash funds in the company cashbox will decrease by 10,000, and the manager cashbox will be replenished by 10,000.

Example 2. The manager posts to the company cashbox the funds in the amount of 10,000 previously withdrawn from the company current account. To carry out this operation, you need to go to the Company Cashbox, click Cash Transactions, in the Put in Cashbox field, enter the amount of 10,000, select “Cash” - “Internal”, click “Save. After the operation, the amount of cash in the company cashbox will increase by 10,000, and the manager cashbox will decrease by 10,000.

Example 3. The owner of the company (Administrator) at the end of the year receives and withdraws profits in the amount of 100,000. To carry out this operation, you need to go to the Company Cashbox, click Cashbox Operations i>, in the Picked up from the cashbox field, enter the amount 100000, select Cash - External, click Save. After the operation, the amount of cash in the Company Cashbox will decrease by 100,000.

Below is a list of all transactions carried out at the company cashbox. It, among other things, includes transactions carried out at the cashbox of each employee. If you need to display transactions made more than 30 days ago, you must select the start and end dates of the period of interest in the appropriate fields. You can also filter transactions by income/expense group and search by parameters, create new payment (expense or income transaction) and upload the list of transactions to the table.